What is Margin Call?

Margin call is a notification from a broker warning that the value of your assets has dropped to a level that may lead to forced closure of positions. Such a notification can only be received when trading on margin (using leverage), since the transaction uses borrowed funds (margin) from the broker. This is where the name of the term Margin call comes from, which translated into Russian means “warning about insufficient margin to support a transaction in the market”.

How to find out the level of Margin call?

Forced closure levels of transactions are calculated depending on the type of market and the trading instrument you are operating.

On the stock market, Margin call is triggered when the margin falls below the initial risk rate (it is individual for each instrument). For example, in the case of Sberbank shares, the initial risk rate for a long position is set at 30%. This indicates that the share of equity in the value of the position must be at least 0.3. If the position goes into the red and you have less than 0.3 (30%) of your own assets left in your account from the margin (collateral) value for the transaction, the latter will be forcibly closed. If there are several transactions, the most unprofitable of them is closed.

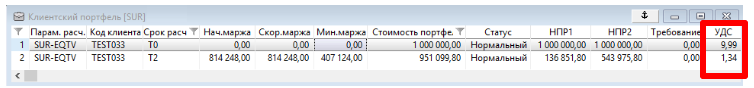

In the popular trading terminal QUIK, you can track the Margin Call level through the UDC - Funds Adequacy Level indicator.

UDC = (Portfolio Value - Min. Margin) / (Initial Margin - Min. Margin)

Used to assess the degree of proximity to forced closure.

- UDC < 1 - proximity to closure (margin call);

- UDC < 0 — forced closure

Example:

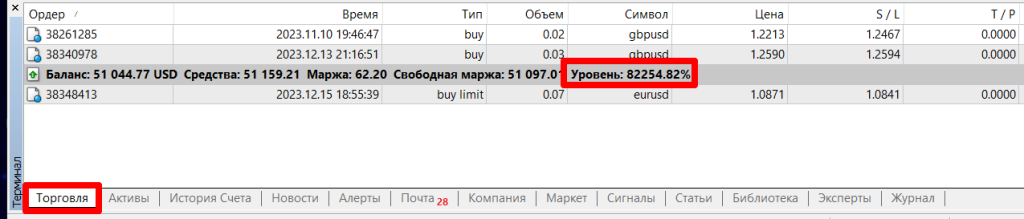

On the FOREX currency market, instead of the concept of “initial risk rate” and UDS, the “Level” indicator is used in the “Trade” tab of the “Terminal” menu:

The “Level” limit is calculated using the formula: Equity / Margin and varies depending on the account type and usually amounts to 20/60/100%

To avoid closing trades, you can either top up your account, thereby increasing the ratio of equity to margin; or close some of the trades, reducing some of the margin load on the account. The third option is to hope that the current situation will improve before the threshold value is reached.

In order to avoid a critical situation, it is worth learning how to calculate the volume of positions opened and mastering other rules of capital management - money management, as well as having a certain reserve of funds before the Margin call.