What is leverage?

Leverage is the use of borrowed funds to increase the potential return on investment. In financial markets, leverage is provided by your broker at the time of a trade or investment transaction. This allows you to borrow an amount that can be 10, 20, 100 times or even more than your initial deposit.

What are the benefits of using leverage?

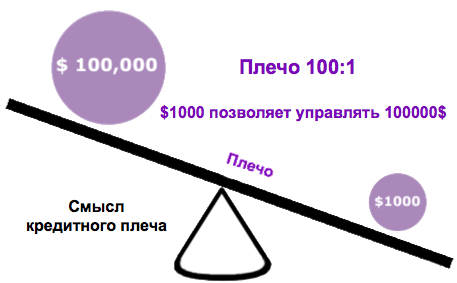

This tool acts as a mathematical multiplier, which gives investors the opportunity to increase their purchasing power in the market by the amount of this leverage. By using a brokerage multiplier, you provide the broker with collateral or margin for the duration of the transaction. The mathematical representation of leverage itself has the form of a proportion, where the numerator is your collateral funds, and the denominator is the broker's credit funds.

Example of leverage:

If a trader wants to open a trade on the EUR/USD currency pair of 1 lot (or 100,000 euros) with a leverage of 1:100, he will receive 100 borrowed euros for every 1 of his own euros. That is, you only need to have 1,000 real euros in your account as collateral for the trade. This means that you can open a transaction of a much larger volume than your own deposit usually allows.

However, it is important to note that while leverage can increase potential profits, it also increases potential risk. If the market moves against the trader, there is a chance that the current position will be completely closed if the trader's equity minus the funds frozen in open transactions (margin) reaches zero (this requirement may vary depending on the trading conditions of the chosen broker).

To effectively use leverage, it is essential for traders to have a clear trading strategy, calculate the risk levels for each transaction, and avoid randomly opening trades without taking into account the size of their deposit. In other words, have a capital management system (money management) and do not exceed a reasonable risk level.