What is stop-loss

When trading and investing in financial markets, we often face the question: how to protect our investments if our initial forecast for the movement of a financial asset turns out to be incorrect?

A special order (a request to a broker) is used for such cases - Stop Loss or Stop Market (from English stop loss, sl, "limit loss").

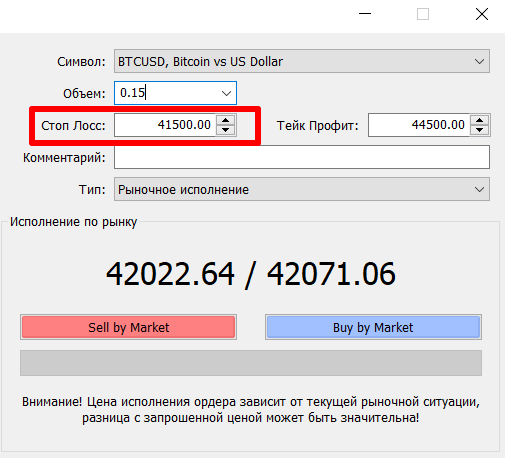

You can give this trading order to your broker when placing a deal on the market. As a rule, stop loss parameters are set in the order settings, in which you specify the exit price for this deal. If the market price reaches the specified values, the broker automatically sends an order to close.

Example of setting Stop Loss in the Meta Trader4 trading terminal

Thus, you can not only limit potential losses, but also automate your trading in the financial markets. You will not need to constantly be at the monitor to control your operations. You determine the exit price in advance by profit - “take profit” or loss - “stop loss” and just wait for the execution of one of the parameters. This allows you to avoid making emotional decisions, especially when market fluctuations intensify.

Also, the term “stop loss” is not always associated only with losses, if the price has already passed a certain number of points in the direction of your order, you can move sl first to the breakeven zone, and then completely fix the lower profit threshold if the price suddenly rolls back.

To summarize, we note that stop loss is a kind of safety net for your investments, which will help automate the work process and make the results of transactions more predictable.