Trader's calculator

How to use the calculator

-

Select currency pair (symbol)

-

Specify the trade size in lots

-

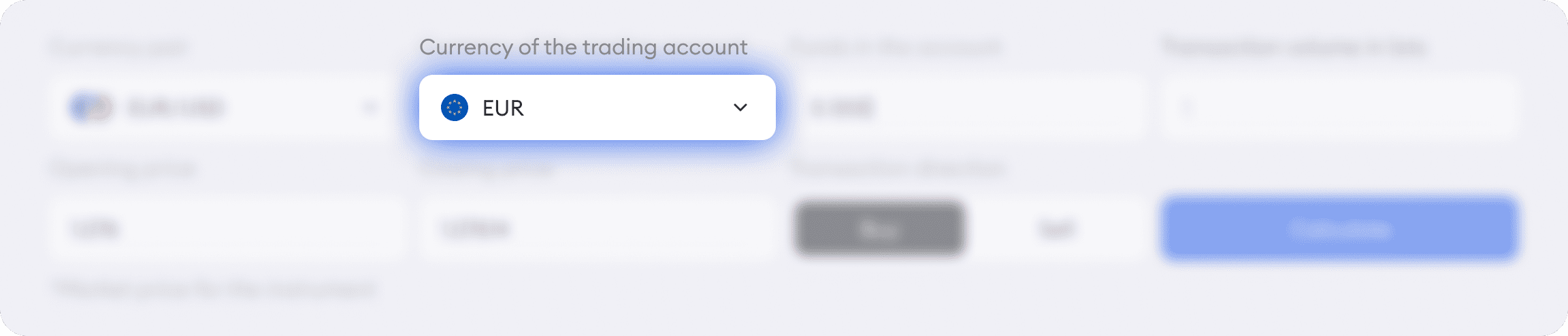

Select the currency your trading account is denominated in

-

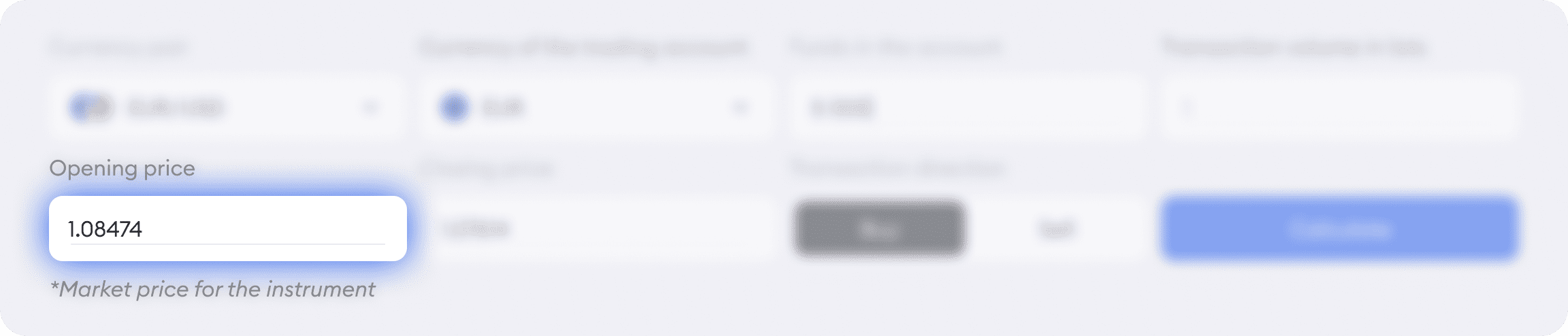

Set the position opening price (by default, the field contains the current market price)

-

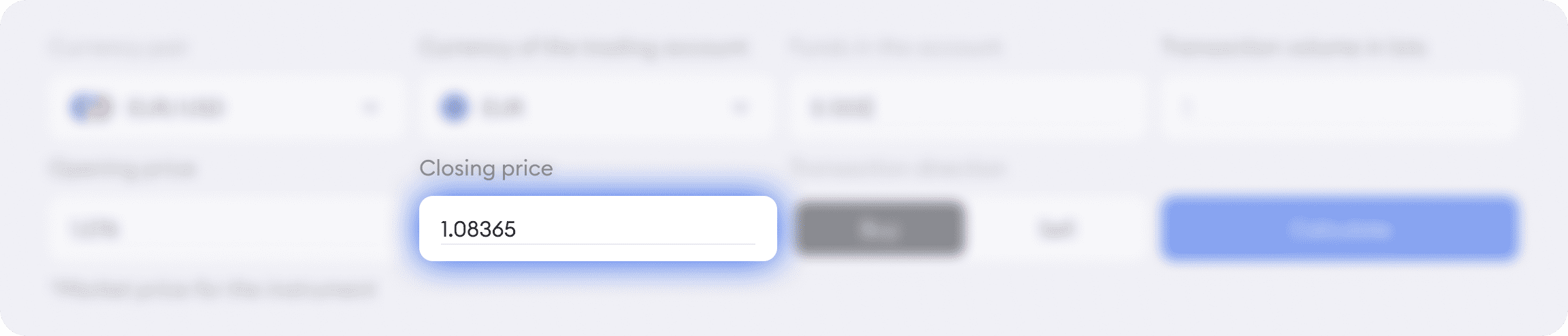

Set the closing price of the position (by default, the field contains the current market price)

-

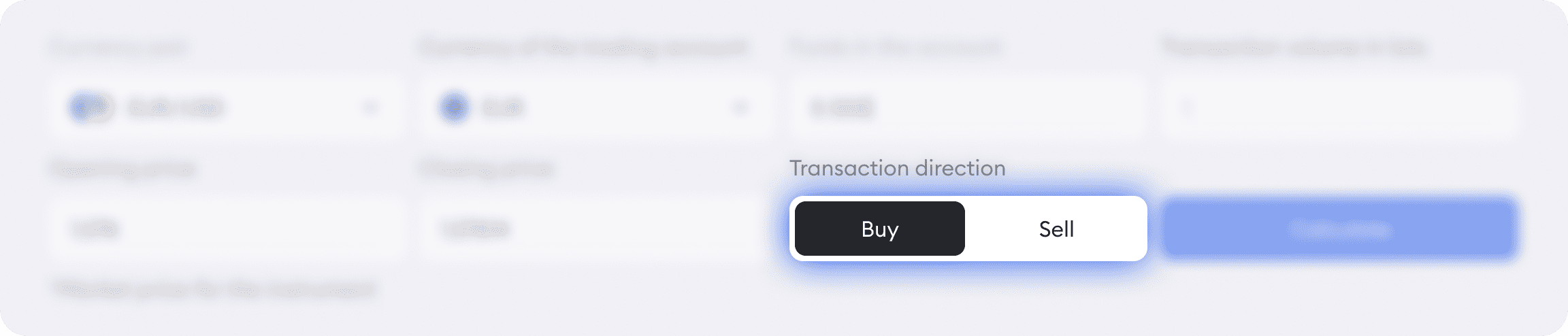

Select «Sell» or «Buy»

-

Click «Calculate». You will see the financial result of the transaction, opened and closed on the selected conditions

Example of calculations

The trading calculator also shows the free margin on the account after closing the close and the margin level.

Free Margin is the difference between the account equity and open bond margin. For example, if a position is opened on an account of 120,000 rubles with a true result of 3,000 rubles, and the margin (margin) is 70,000 rubles, then the free margin will be equal to:

120,000 + 3,000 - 70,000 = 53,000.

These funds are used to open new ones.

If one or more positions on the account when losses occur, funds (capital) may become less than collateral. In such cases, the free margin will be negative.

Margin Level — this is the ratio of account equity to margin under influence, expressed as a percentage. For example, if the pledge (margin) is 40,000 rubles, and the funds in the account are 200,000 rubles, then the margin level will be:

200,000 / 40,000 * 100 = 500%.

An increase of 100 is required to convert the result to a percentage. In other words, a margin level of 500% means that the margin is five times less than what is in the account.

The trading calculator also shows the free margin on the account after closing the close and the margin level.

Free Margin is the difference between the account equity and open bond margin. For example, if a position is opened on an account of 120,000 rubles with a true result of 3,000 rubles, and the margin (margin) is 70,000 rubles, then the free margin will be equal to:

120,000 + 3,000 - 70,000 = 53,000.

These funds are used to open new ones.

If one or more positions on the account when losses occur, funds (capital) may become less than collateral. In such cases, the free margin will be negative.

Margin Level — this is the ratio of account equity to margin under influence, expressed as a percentage. For example, if the pledge (margin) is 40,000 rubles, and the funds in the account are 200,000 rubles, then the margin level will be:

200,000 / 40,000 * 100 = 500%.

An increase of 100 is required to convert the result to a percentage. In other words, a margin level of 500% means that the margin is five times less than what is in the account.

How to use the calculator

Buy/Sell – when you are trading the Forex market, you can either buy an asset if you predict its price will rise or sell it if you think its value will decrease. For example, if you bought euros for dollars, and the euro went up, you sell euros for more dollars.

Contract size - it’s a designation of the size of the contract, traditional for the Forex market. It is calculated as the size of a standard lot multiplied by the number of lots. The standard lot size in Forex is 100,000 units of the base currency.

An instrument – it’s an asset that you are trading. It is also called the Leverage symbol - the ratio of margin (collateral) to the nominal value of the position. The company has a leverage of 1:100. This means that to open a transaction with a volume of 10,000 euros, you will need to have 40 times less on your trading account (10,000/40=250 euros). If the account is denominated in another currency, the amount of margin required to open a transaction is calculated at the market rate.

Lot is a traditional designation in the Forex market for the volume of a transaction with currencies.

Standard lot or 100,000 units of the base currency.

Mini lot or 10,000 units of the base currency.

Microlot or 1000 units of the base currency.

Buy/Sell – when you are trading the Forex market, you can either buy an asset if you predict its price will rise or sell it if you think its value will decrease. For example, if you bought euros for dollars, and the euro went up, you sell euros for more dollars.

Contract size - it’s a designation of the size of the contract, traditional for the Forex market. It is calculated as the size of a standard lot multiplied by the number of lots. The standard lot size in Forex is 100,000 units of the base currency.

An instrument – it’s an asset that you are trading. It is also called the Leverage symbol - the ratio of margin (collateral) to the nominal value of the position. The company has a leverage of 1:100. This means that to open a transaction with a volume of 10,000 euros, you will need to have 40 times less on your trading account (10,000/40=250 euros). If the account is denominated in another currency, the amount of margin required to open a transaction is calculated at the market rate.

Lot is a traditional designation in the Forex market for the volume of a transaction with currencies.

Margin/collateral – funds in a trading account required to open a position and maintain it in the market.

Point - this is the minimum amount by which the price of an asset can change. In the trading terminal, currencies are usually quoted with an accuracy of five, four and three decimal places. For the EURUSD quote 1.08772, one point is 0.00001 dollar. For USDRUB at a price of 74.1234, one point is 0.0001 ruble or 0.01 kopecks). For the USDJPY 106.649 quote, one point is equal to a price change of 0.001 yen. When computer power was lower, currencies were quoted with less accuracy. An experienced trader can call the change not the last sign of the quote, but the penultimate one, a point.

Profit - it's a term that needs no explanation. Losing trades will be displayed in the terminal with a minus sign.

Swap / triple swap - a swap is a fee for rolling over a position to the next day. The swap is calculated as the difference between the discount rates of the countries whose currencies are present in the currency pair, divided by 365. An insignificant dealer markup is added to the swap. Swap can be either negative or positive. Rolling over a certain position overnight can make you a profit. A triple swap is deducted or credited for moving a position over the weekend. In most cases this happens on the night from Wednesday to Thursday.

Tick - it's the minimum step of price change. For currency pairs, tick and pip are equivalent. But in the stock market, the minimum move will not necessarily be a change of 0.00001 or 0.0001. For stocks, the step can be, for example, $0.25 or 25 points.

Margin/collateral – funds in a trading account required to open a position and maintain it in the market.

Point - this is the minimum amount by which the price of an asset can change. In the trading terminal, currencies are usually quoted with an accuracy of five, four and three decimal places. For the EURUSD quote 1.08772, one point is 0.00001 dollar. For USDRUB at a price of 74.1234, one point is 0.0001 ruble or 0.01 kopecks). For the USDJPY 106.649 quote, one point is equal to a price change of 0.001 yen. When computer power was lower, currencies were quoted with less accuracy. An experienced trader can call the change not the last sign of the quote, but the penultimate one, a point.

Profit - it's a term that needs no explanation. Losing trades will be displayed in the terminal with a minus sign.

Swap / triple swap - a swap is a fee for rolling over a position to the next day. The swap is calculated as the difference between the discount rates of the countries whose currencies are present in the currency pair, divided by 365. An insignificant dealer markup is added to the swap. Swap can be either negative or positive. Rolling over a certain position overnight can make you a profit. A triple swap is deducted or credited for moving a position over the weekend. In most cases this happens on the night from Wednesday to Thursday.

Tick - it's the minimum step of price change. For currency pairs, tick and pip are equivalent. But in the stock market, the minimum move will not necessarily be a change of 0.00001 or 0.0001. For stocks, the step can be, for example, $0.25 or 25 points.

The calculation results are for informational purposes only. There is no purpose of offering products or services here. Before making trading decisions, we recommend that you familiarize yourself with the regulatory documents of Neomarkets.